Angaza, together with SIMA, announces the launch of the SIMA Angaza Distributor Finance Fund (DFF), a data-driven investment fund that will provide much-needed access to debt capital for last-mile distributors. DFF will invest in distribution companies working to provide clean energy access for all in emerging markets, thus addressing one of the biggest barriers to their growth: lack of funding opportunities.

While investments in the off-grid energy sector increased by 20% from 2017 to 2018, the growth rate falls short of meeting the $5.7 billion needed until 2022 to sufficiently accelerate the sector. This dearth of funding especially impacts distributors selling life-changing products on a pay-as-you-go basis. These last-mile distributors need capital to fill the cash flow gap they experience by virtue of receiving installment payments over time instead of the full price of the product at the point of sale.

To financially strengthen last-mile distributors providing affordable access to life-changing products, the SIMA Angaza Distributor Finance Fund will launch with an initial investment from Ceniarth and the Skoll Foundation, and from the Shell Foundation, a UK charity that is also introducing funding from the UK Department for International Development, USAID, and Power Africa.

“We are excited to partner with Angaza on the SIMA Angaza Distributor Finance Fund,” says Erin Davis, Vice President of SIMA. “By investing in distributors selling life-changing products in emerging markets, DFF aligns well with our mission to create and scale profitable businesses with exemplary financial, social, and environmental impact.”

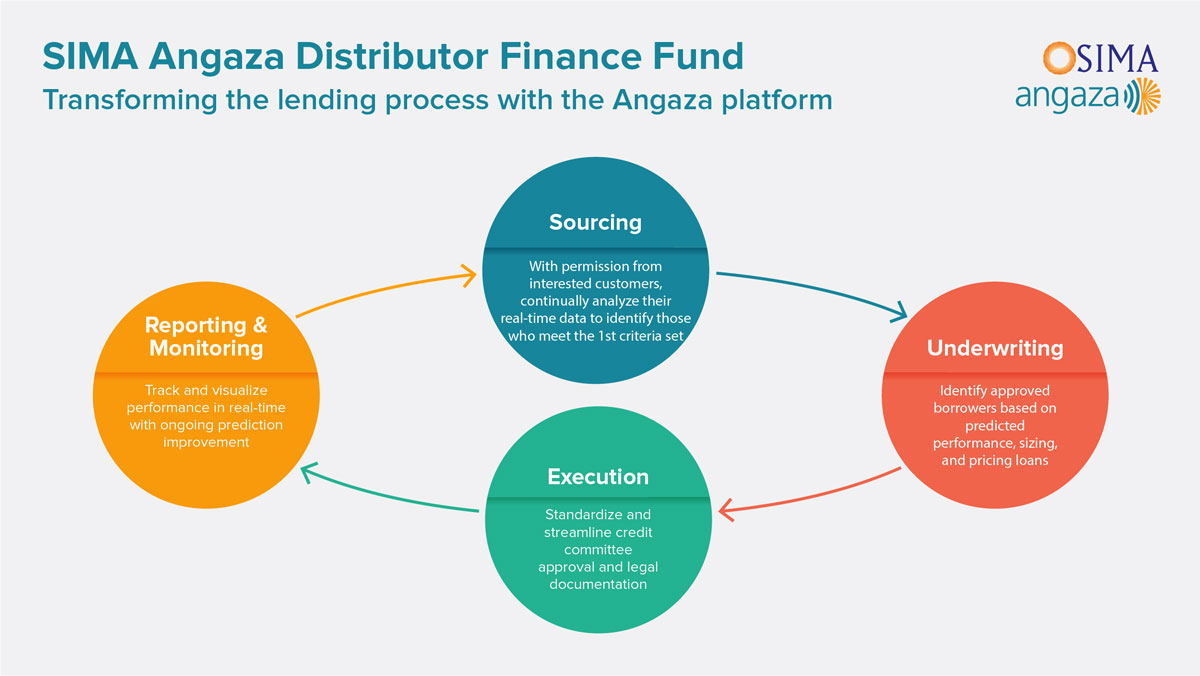

With permission from interested Angaza distributors, DFF will leverage data from the Angaza Hub to assess eligibility for funding, reduce the duration and complexity of due diligence, and monitor and report on loans. Angaza and SIMA will jointly make decisions and manage DFF by combining Angaza’s data analytics expertise with SIMA’s extensive experience lending to distributors who advance clean energy access.

“We anticipate that this data-rich approach to underwriting and monitoring loans will reduce the costs of providing credit to a range of distributors that can’t currently access finance,” says Gareth Zahir-Bill, Director of Operations at the Shell Foundation. “Through the SIMA Angaza Distributor Finance Fund, we are proud to back an innovation that makes increasing access to affordable solar energy in underserved communities economically viable.”

“Many distributors cite lack of access to working capital as their number one barrier to growth; the SIMA Angaza Distributor Finance Fund aims to solve this,” says Angaza CEO Lesley Marincola. “This fund will have a catalytic impact in driving business growth for distributors by leveraging centralized, real-time data analytics to de-risk working capital loans and attract more lenders to invest.”

By providing debt capital to traditionally overlooked distribution businesses, the data-driven SIMA Angaza Distributor Finance Fund will help accelerate the growth of the off-grid energy sector while increasing access to life-changing products for families in emerging markets.

If you are an Angaza customer interested in learning more about the SIMA Angaza Distributor Finance Fund, please visit contact.angaza.com/distributor-finance-fund.