The SIMA Angaza Distributor Finance Fund (DFF) is a data-driven investment fund providing much-needed access to debt capital for last-mile distributors. DFF invests in companies distributing life-changing products in emerging markets, addressing one of the biggest barriers to their growth: lack of financing.

Seeing Beyond Zambia’s Macroeconomic Risk

“Zambia’s default fuels fears of African ‘debt tsunami,” stated The Guardian in November 2020. This is the kind of press that Zambia has attracted since missing a US$42.5 million payment on a Eurobond. Still, Zambia’s macroeconomic instability did not intimidate Rune Dige, CEO and founder of RDG Collective (RDG), one of the SIMA Angaza Distributor Finance Fund (DFF) portfolio companies. In fact, it was a source of motivation to show that “it pays to do good, even in the most challenging markets,” explains Rune.

Rune has a background in global development and six years of consulting experience in the Middle Eastern clean energy sector. His goal has long been to improve livelihoods by expanding access to clean and financially sustainable energy solutions. Rune decided to pursue this dream full-time after witnessing the successes of for-profit social businesses in the energy sector, like Greenlight Planet. Convinced of Rune’s leadership abilities, one of his consulting clients decided to fund the launch of a new off-grid solar business, RDG Collective. After researching several potential markets for his business across Africa, Rune selected Zambia for a few reasons. First, Zambia boasts a large and untapped market for solar energy. Indeed, USAID Power Africa reports that 7.2 million people in Zambia have no access to grid power, and off-grid solar competition is weak. Second, launching in a challenging context would ensure strong business discipline. “If we can make it in Zambia, we can scale RDG across Africa,” Rune states. This bet on Zambia ultimately caught DFF’s eye, given the fund’s goal of unlocking access to capital in underserved markets.

RDG is Guided By a Strong Approach to Business Strategy and Talent Acquisition

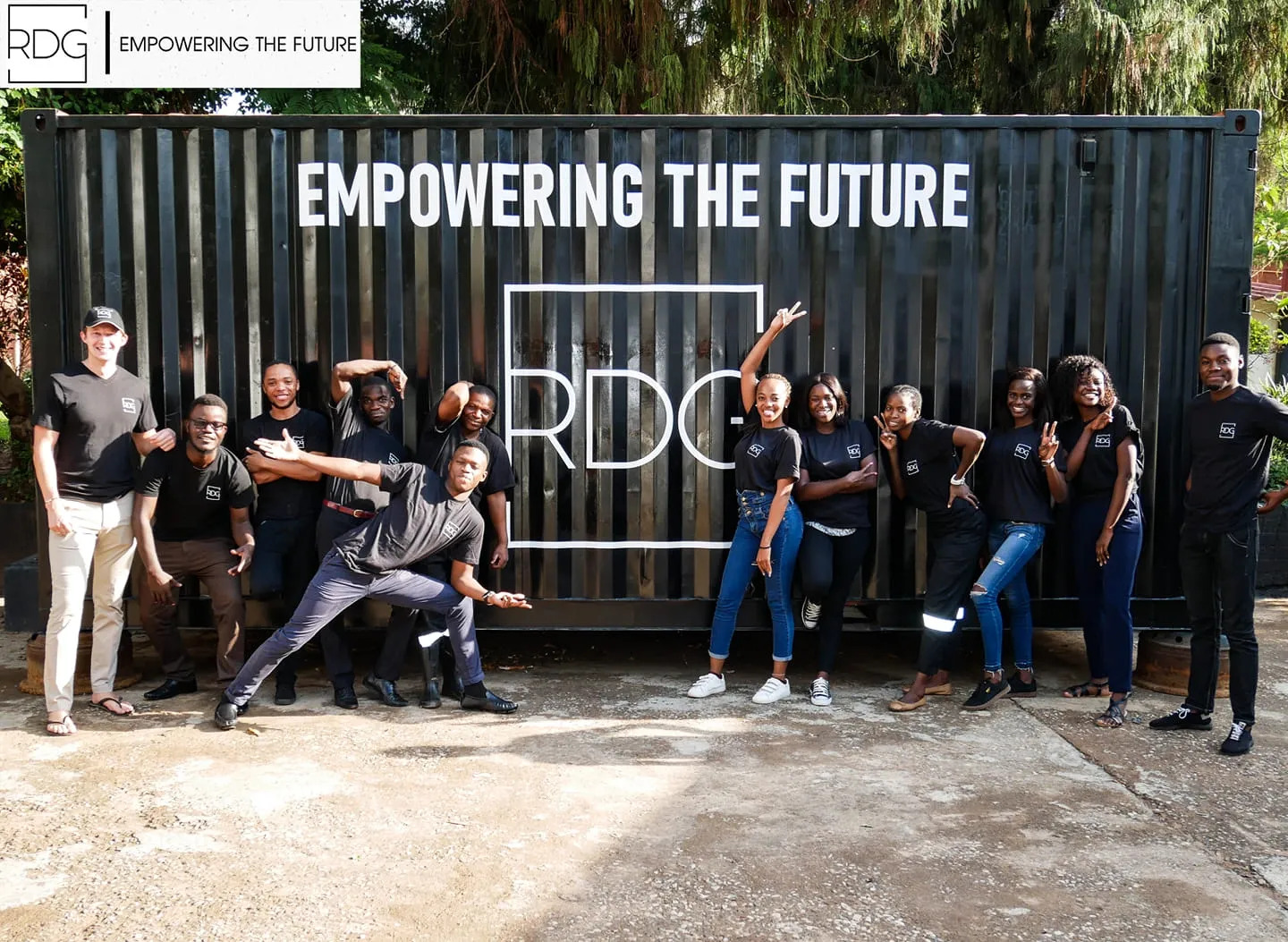

DFF was also impressed with RDG’s commercial, talent and cost management strategy. The company’s slogan is “empower the future,” which Rune believes begins with providing access to income generation opportunities. Indeed, RDG focuses on selling affordable, large solar home systems that can power electronics like appliances or computers. Also, a consistent focus on collections and repossessions has enabled the company to maintain a high-quality pay-as-you-go lending portfolio. Rune has coupled this commercial approach with a strong talent model. “I look for young, educated, and local talent that can grow with the company,” Rune comments. Apart from himself, everyone at RDG is Zambian, and the average employee age is 27 years old. Further, Rune is creative when it comes to sourcing talent, as his first employee can testify. Rune met her when she was still an Emirates customer service supervisor. Marked by a positive experience when resolving a ticketing issue, Rune offered her a job on the spot. She went on to become Operations Manager and a key part of RDG’s success.

Rune is also intent on encouraging employee ownership in the workplace. Every new hire signs a contract of excellence, signaling that RDG is about more than just a paycheck. In turn, RDG’s strong local team ensures business continuity, as Rune is based part-time outside of Zambia. This capable team has devised creative tactics to manage costs, for instance by performing final assembly. All in all, the company has shown impressive initial signs of success, having reached profitability within just one year of operation. All this, without receiving a dollar of grant support.

The Distributor Finance Fund Observes Potential for Growth Despite Macroeconomic Challenges

Still, growing RDG has come with its challenges. One of the biggest hurdles RDG has faced is securing capital. The RDG team requires capital up front to purchase inventory for future sales. Meanwhile, because of their pay-as-you-go consumer financing model, cash collections on past sales take place over a one to two-year time frame. This delay creates a cash deficit, making RDG dependent on external financing to fill the gap. Unfortunately, Zambia’s macroeconomic risk has deterred foreign investors. The Zambian Kwacha has depreciated by over 45% against the US dollar over the past two years. Meanwhile, local commercial banks have historically been unwilling to invest significant sums in pay-as-you-go businesses. By using data from the Angaza software platform, the DFF team was able to discern RDG’s potential for continued growth despite the difficult macroeconomic context. Given RDG’s success in navigating these recent headwinds, we are confident they will thrive in easier times.

The Future is Bright for RDG

What’s next for RDG? The team seeks to expand into new product lines such as solar water pumps, refrigerators, and smartphones, thus keeping to the company thesis of enabling income generation opportunities. They are also setting up free training services on topics like sustainable farming, which will help end-customers make the most of RDG products and increase the likelihood of repayment. In turn, RDG will continue to benefit from healthy collection rates. Finally, they are eyeing an expansion into neighboring geographies, such as Mozambique.

Parabéns, RDG team, lhe desejamos muito sucesso no futuro (congratulations, RDG team, we wish you much success in the future)!